The Innovation Formula: How Incumbents Can Get Future-Ready

Yes, incumbents can win the future by owning the next horizon of innovation.

It’s hard – even bleak – out there for incumbents. Organizational leaders in every industry have seen depressing headlines. And while it’s true that nearly 8 in 10 CEOs say that growth and innovation are top priorities, most of those same CEOs say their companies continue losing ground to start-ups and other competitors.

So why are the results so often disappointing? In our experience, even well-managed firms struggle to accept the massive uncertainty of the business landscape today. The mindsets required for sustained momentum and continuous adaptation don’t take hold. The cultural shifts don’t happen that are necessary to instill growth and innovation within the DNA of the organization.

Given the constant turnover and ever-briefer tenures on the S&P 500 – not to mention all the love unicorns get in the business press – it’s easy to forget that large corporations have substantial advantages. Ample funding, large customer bases, deep and broad institutional knowledge – are the key foundations for sparking growth through innovation.

This article describes an innovation formula that capitalizes on these assets. The formula may be simply expressed as “mindset + mechanics” – reflecting our belief that innovation happens via the combination of thinking creatively and acting boldly. By following this formula, senior leaders can get past the challenges of incumbency and move confidently to win the future. The implications of the formula and process we outline below can guide firms as they set their innovation strategy for 2023.

Getting to New Mindsets and Behaviors

The new mindsets and behaviors necessary for innovation can take many forms:

Thinking like entrepreneurs and attackers: Most start-ups would kill to have the strong balance sheets, deep teams and broad expertise that many incumbents possess. But those organizational assets can lead to an internal orientation, where leaders prioritize solving inward-facing business or organizational problems over recognizing market truths and identifying customer needs. The most successful entrepreneurs are relentless in their external focus, which also energizes attacker and challenger brands.

Going deeper on customer needs: Speaking of customer insight, many large firms seem content to outsource this critical work. To be clear: independent research is valuable, but a customer orientation must be deeply embedded within the organizational culture to spark breakthrough innovations. That means understanding the core emotional states and deep psychological needs that motivate consumers.

Resisting Hail-Mary innovation strategies: Large companies often delay the hard choices involved in funding innovations and move too slowly in exploring new ideas. Leaders at successful businesses may feel no urgency to fix what doesn’t seem broken. Then, having fallen behind nimbler competitors, they feel forced to go all-in on new ideas already in development. This “Hail-Mary” approach is destined to fail, and it turns one important advantage of incumbency – large amounts of capital – into a disadvantage.

Investing like VCs: If thinking like an entrepreneur is energizing, investing like a venture capitalist is stabilizing. Big firms should position capital for maximum impact, managing a portfolio of innovations – from early-stage concepts to pilots and prototypes to tested products – rather than going all-in on a single big bet. “Go/no-go” decision-making milestones should feature clear and quantified criteria (e.g., customer adoption) that must be met if new products are to advance. An objective investment committee should oversee “gated,” evidence-based decision-making processes that provide access to “tranches” of funding. This approach reduces the risk of falling in love with unworkable ideas and promotes “failing fast”.

Tapping Into the Mechanics of Innovation and Growth

Many innovations are thought to arise entirely from geniuses' minds or lightning-strike inspirations. In the real world, though, innovations can be traced to specific types of opportunity and market conditions.

Market dynamics: systemic friction from major trends, shifts, and dynamics

Powerful innovations in healthcare result from persistently high costs and advancing medical knowledge and understanding of the disease. The rise of outpatient procedures was driven by the confluence of cost pressures and vastly improved surgical techniques and equipment. Increased financial literacy, greater transparency, and network technology have led to index investing and day trading in financial services.

Blatant frictions: the problems everyone – including customers – can see

Ride-sharing took off largely because taxis were terrible and public transportation options were limited. In entertainment, because people want more options (and enjoy them on demand), cable replaced network television, and streaming services are replacing cable.

Latent need: emotional desires that products and services should satisfy

People love mobile payment apps and e-commerce because they’re easy and convenient. Looking back, they flocked to the original iPod because it allowed them to do something they never thought possible – access vast amounts of music anytime, anywhere. Likewise, consumers let insurance companies access their wellness data because they want to lead healthier lives and like premium discounts.

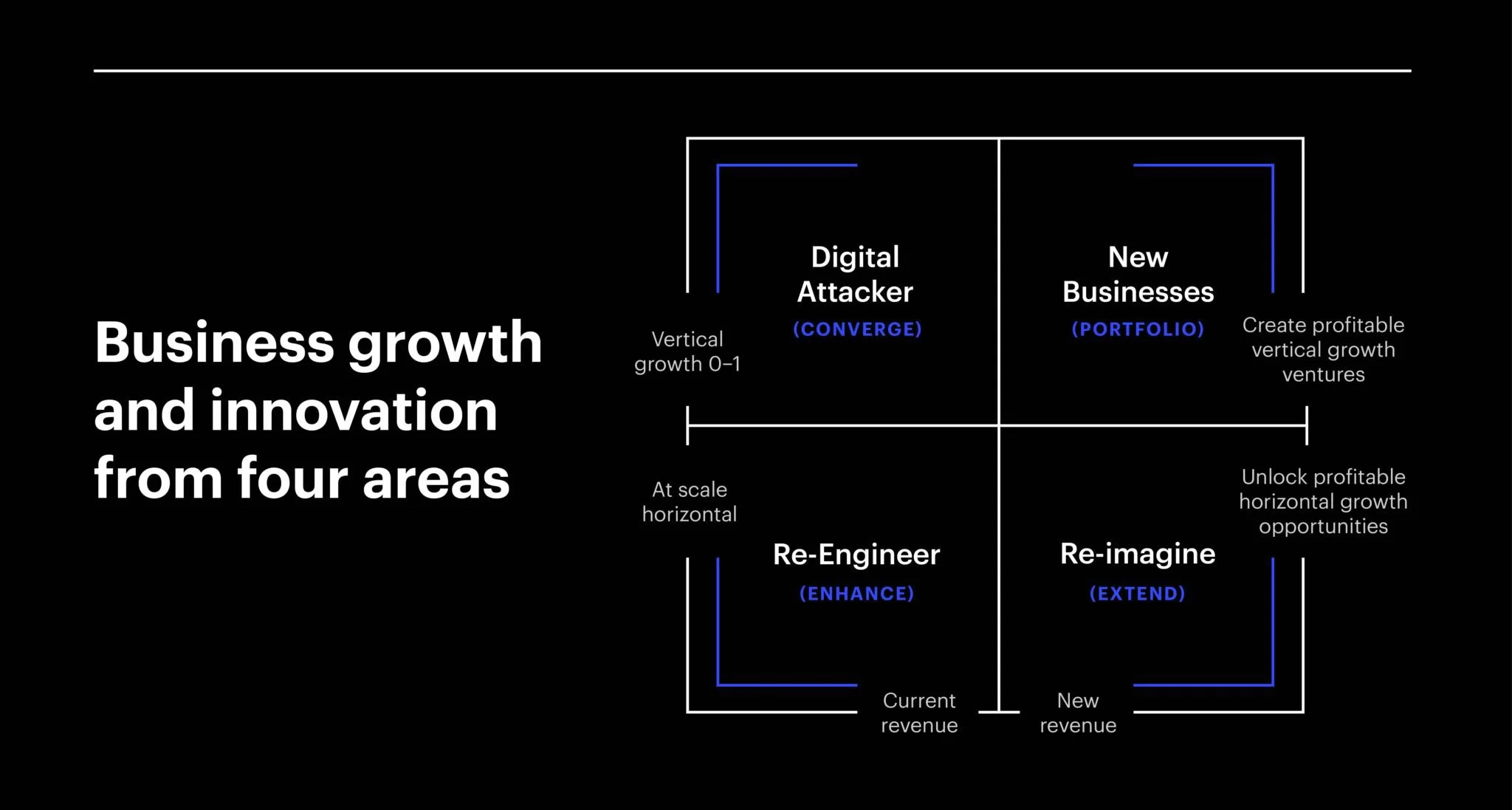

By asking, “Why are we innovating?” and “Why should our customers care about our innovation?” leaders can identify the most promising areas of innovation. The answers to such questions will also help determine the best paths to growth, including entirely new ventures that can scale vertical and horizontal extensions of existing businesses.

Innovation as a Process

The most innovative companies adopt both a tactical and practical approach to innovation – that is, they instill it not just as part of the culture but also as a key element of standard operating procedures. They apply traditional business activities (e.g., financing, cost management, resourcing and talent management, product design, marketing and sales and performance measurement) to the practice of innovation.

This perspective may seem less glamorous than the common conceptions of visionary entrepreneurs. But a disciplined, well-funded and repeatable approach is how larger enterprises can take advantage of their inherent strengths. The core steps are:

1. Defining the portfolio for growth: producing a well-defined hypothesis through ideation and exploration.

The first step in innovation is to generate a set of concepts or hypotheses for minimally viable products (MVPs) that are worthy of design, building and testing during the incubation phase. A company might identify a disruptive digital business model and then identify the future customer base. Future-back ideation can help innovation teams to understand tomorrow’s market, recognize the most powerful drivers of change and establish a vision for the future. Well-designed portfolios can minimize risk, drive a deeper understanding of product-market fit and, thus, improve success rates.

2. Building the business: creating, nurturing and validating minimally desirable products.

This step brings ideas to life through the rapid design of the user experience and core platform. MVP concepts should be tested with real users and refined to become minimally desirable products (MDPs) as quickly as possible. Further testing should guide the deployment of MDPs in the market and help teams evaluate the best path for commercialization.

Speed counts in this phase; companies that move faster can fail faster, find winning concepts sooner and, ultimately, grow quicker. Timing matters, too; successful new businesses balance desirability and feasibility to meet current needs based on currently available technology.

3. Commercializing the offering: completing the product and launching the business.

As the focus on product design inevitably gives way to an emphasis on product management, companies should carefully measure results with users in order to identify iterative improvements (e.g., new features). A well-defined go-to-market plan is critical for successful execution. Operating with lean start-up principles in launching the business can lay the foundation for rapid growth, assuming there is sufficient capital (both human and financial) to support a viable path to scale.

Written by Eric Pilkington, Managing Partner